Have you ever wondered how much your home will be worth in 10, 20, or even 30 years? It’s not just a curiosity—it’s a question that could significantly impact your financial future.

Whether you’re a homeowner planning for retirement or a real estate investor looking for your next big opportunity, understanding home appreciation is crucial.

In this comprehensive guide, we’ll demystify home appreciation and introduce you to a powerful tool: the Home Appreciation Calculator.

Don’t leave your future to chance—read on to take control of your real estate destiny.

Key Takeaways

- Home appreciation refers to the increase in a home’s value over time. Factors influencing home appreciation include location, market trends, and home improvements.

- A home appreciation calculator is a tool that estimates the future value of a home based on its current value, the expected annual appreciation rate, and the number of years.

- Home Appreciation Calculator can help homeowners and real estate investors make informed decisions about selling, refinancing, or investing in property. It can also assist in goal-setting and financial planning.

- The future value of a home is influenced by the rate of home appreciation. Understanding this can help homeowners build equity and make successful real estate investments.

- Home appreciation is not guaranteed and can be influenced by various factors. A home appreciation calculator provides an estimate, not a guarantee.

Simple Home Appreciation Calculator

This calculator is perfect for homeowners and real estate investors who want a quick and easy way to estimate the future value of a property based on its current value and an expected annual appreciation rate. It’s a great tool for planning and decision-making, whether you’re considering selling your home, refinancing your mortgage, or making home improvements.

Instructions:

- Enter the current value of your home in the “Purchase Price/Current Value” field.

- Enter the expected annual appreciation rate (as a percentage) in the “Annual Appreciation Rate” field.

- Enter the number of years you plan to hold onto your property in the “Number of Years” field.

- Click the “Calculate” button to get an estimate of your home’s future value.

Advanced Home Appreciation Calculator

This calculator is ideal for more advanced users who want a comprehensive understanding of their home’s potential appreciation. It takes into account the purchase price, down payment, and target sales price, providing a more detailed picture of your potential return on investment. It’s an excellent tool for real estate investors and homeowners who are serious about maximizing their wealth through real estate.

Instructions:

- Enter the purchase price of your home in the “Purchase Price” field.

- Enter the percentage of the purchase price that you paid as a down payment in the “Down Payment Percentage” field.

- Enter the number of years you plan to hold onto your property in the “Number of Years” field.

- Enter the expected annual appreciation rate (as a percentage) in the “Appreciation Per Year” field.

- If you have a target sales price in mind, enter it in the “Target Sales Price” field.

- Click the “Calculate” button to get an estimate of your home’s future value and the required annual appreciation rate to reach your target sales price.

Table of Contents

- Simple Home Appreciation Calculator

- Advanced Home Appreciation Calculator

- Understanding Home Appreciation

- The Role of a Home Appreciation Calculator

- How to Use a Home Appreciation Calculator

- Case Studies: Real-Life Applications of a Home Appreciation Calculator

- Future Value and Home Appreciation

- Building Equity

- Home Appreciation and Real Estate Investment

- Understanding the Financial Aspects of Home Appreciation

- Common Myths and Misconceptions

- FAQ

- Conclusion

Understanding Home Appreciation

Definition and Explanation

Home appreciation is the rate at which the value of your home increases over time. It’s influenced by a variety of factors, from the condition of your home to the state of the real estate market. The great thing about home appreciation is that it can turn your home into a powerful investment tool, helping you build wealth over the long term.

Factors Influencing Home Appreciation

| Factor | Description | Impact on Home Appreciation |

|---|---|---|

| Location | The geographical location of a property, including its proximity to amenities, schools, and employment opportunities. | Properties in desirable locations tend to appreciate more. |

| Market Trends | The overall trends in the real estate market, including supply and demand dynamics and economic conditions. | In a seller’s market or booming economy, home values may appreciate more. |

| Home Improvements | Upgrades and renovations made to a property, such as kitchen or bathroom remodels. | High-quality improvements can increase a home’s value and appreciation rate. |

| Age and Condition | The age of a property and its overall condition. | Newer homes or those in excellent condition may appreciate more. |

| Community and Neighborhood | The quality of the local community and neighborhood, including crime rates, school quality, and neighborhood amenities. | Homes in safe, high-quality neighborhoods with good schools tend to appreciate more. |

Location and Its Impact

Location, location, location! It’s a mantra in the real estate world for a reason. The location of your property plays a huge role in its appreciation. Properties in desirable neighborhoods, close to amenities like schools, parks, and shopping centers, tend to appreciate more over time.

Market Trends and Economic Factors

The real estate market and broader economic conditions also influence home appreciation. Factors like interest rates, employment rates, and economic growth can all impact how much your home appreciates. Keeping an eye on these trends can help you predict future home appreciation.

Home Improvements and Their Role

Finally, the condition of your home and any improvements you make can also affect its appreciation. Renovations and upgrades can boost your home’s value, leading to higher appreciation. But remember, not all improvements are created equal. It’s important to invest in improvements that add real value to your home.

In the next section, we’ll explore the role of a home appreciation calculator and how it can help you navigate the world of real estate.

The Role of a Home Appreciation Calculator

What is a Home Appreciation Calculator?

Now that we’ve covered what home appreciation is and what influences it, let’s talk about a tool that can help you understand it better – a Home Appreciation Calculator. This is an online tool that estimates how much your home’s value will increase over time. By inputting some basic information about your property and the expected annual appreciation rate, you can get an estimate of your home’s future value. Pretty neat, right?

Why Use a Home Appreciation Calculator?

You might be wondering, “Why should I use a Home Appreciation Calculator?” Well, it’s all about planning and making informed decisions. Whether you’re thinking about selling your home, refinancing your mortgage, or making home improvements, knowing how much your home could appreciate in value can guide your decisions. It’s like having a crystal ball for your home’s future value!

The Benefits of Using a Home Appreciation Calculator

Using a Home Appreciation Calculator comes with several benefits:

- Future Planning: It helps you plan for the future. If you know your home’s potential value, you can make better decisions about when to sell or how much to invest in improvements.

- Financial Management: It can guide your financial management. Understanding your home’s appreciation can help you manage your mortgage, home equity, and overall financial planning.

- Investment Strategy: It can inform your investment strategy. If you’re a real estate investor, understanding potential appreciation can help you choose which properties to invest in.

In the next section, we’ll walk you through how to use a Home Appreciation Calculator.

How to Use a Home Appreciation Calculator

Step-by-Step Guide to Using a Home Appreciation Calculator

Ready to try out a Home Appreciation Calculator? Here’s a simple step-by-step guide:

- Jump to our Calculators: We have created a simple and advanced version at the top of this pagee.

- Input Your Home’s Current Value: Enter the current value or purchase price of your home.

- Enter the Expected Annual Appreciation Rate: This is the rate at which you expect your home’s value to increase each year. If you’re unsure, you can use historical data or consult a real estate expert.

- Specify the Number of Years: How long do you plan to hold onto your property? Enter this number of years.

- Calculate!: Hit the calculate button and voila! You’ll see an estimate of your home’s future value.

Understanding the Results: What Does the Data Mean?

The result you get is an estimate of how much your home might be worth after the specified number of years, given the annual appreciation rate. Remember, this is just an estimate. Real-life factors can cause your home’s value to appreciate at a different rate.

Case Studies: Real-Life Applications of a Home Appreciation Calculator

Case Study 1: Planning for Future Home Sale

Let’s say John bought a home for $250,000. He plans to sell it in 10 years and wants to know how much it could be worth. Using a Home Appreciation Calculator, he finds that with an annual appreciation rate of 3%, his home could be worth around $335,979 in 10 years. This information helps John plan his future finances and decide on the right time to sell.

Case Study 2: Making Informed Real Estate Investment Decisions

Sarah is a real estate investor. She’s considering buying a property for $300,000 in a neighborhood where homes have historically appreciated at a rate of 4% per year. Using a Home Appreciation Calculator, she finds that the property could be worth around $438,225 in 10 years. This potential appreciation makes the property an attractive investment.

In the next section, we’ll explore how home appreciation can impact the future value of your home and contribute to building equity.

Future Value and Home Appreciation

Estimating the Future Value of Your Home

One of the most exciting aspects of home ownership is the potential for your home to increase in value over time. But how can you estimate this future value? That’s where home appreciation and the Home Appreciation Calculator come in. By understanding the factors that influence home appreciation and using a calculator to estimate the annual appreciation rate, you can get a glimpse into your home’s financial future.

How Home Appreciation Affects Future Value

Home appreciation directly impacts the future value of your home. The higher the appreciation rate, the more your home’s value will increase over time. This can be particularly beneficial if you plan to sell your home in the future, as it could result in a higher sale price. However, keep in mind that while appreciation can increase your home’s value, other factors like market conditions and home improvements can also play a significant role.

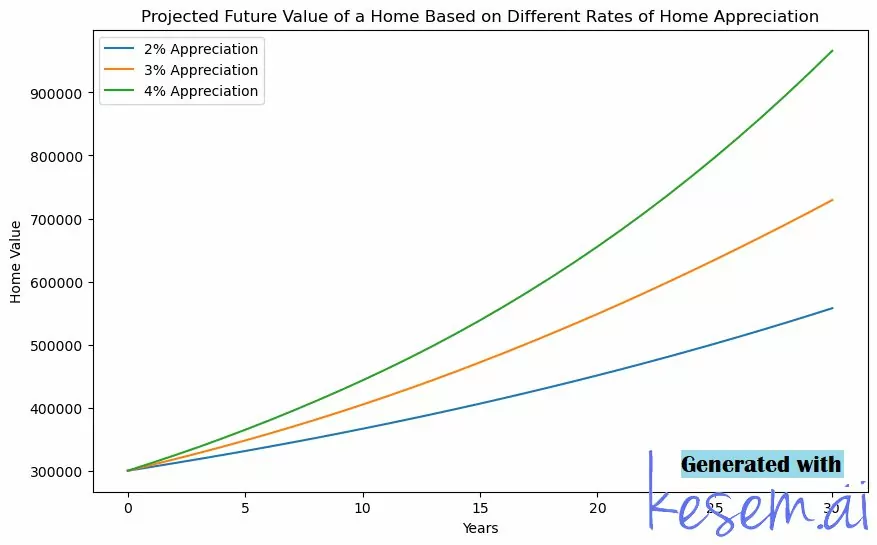

Here is an example chart showcasing the impact of different home appreciations in the case when:

- The current value of the home is $300,000.

- We will project the future value for the next 30 years.

- We will consider three different rates of home appreciation: 2%, 3%, and 4%.

- The appreciation will be calculated annually.

Building Equity

Understanding Home Equity

Home equity is the portion of your home that you truly “own.” It’s the difference between your home’s current market value and the remaining balance on your mortgage. As you pay down your mortgage—or if your home’s value increases—your equity grows.

How Home Appreciation Contributes to Building Equity

Home appreciation is one of the key ways to build equity. As your home’s value increases, so does your equity. For example, if you bought a home for $200,000 and its value appreciates to $250,000, you’ve automatically gained $50,000 in equity. This increase in equity can provide you with more financial options, such as qualifying for home equity loans or being able to sell the home for a profit.

In the next section, we’ll delve into the role of home appreciation in real estate investment.

Home Appreciation and Real Estate Investment

The Role in Real Estate Investment

If you’re a real estate investor, home appreciation is a term you need to be intimately familiar with. It’s one of the key factors that can determine the profitability of your investment. When a property appreciates, it increases in value, which can lead to a higher return when you decide to sell or rent out the property. In fact, many investors bank on appreciation as a significant part of their investment strategy.

Making Successful Real Estate Investments

Understanding home appreciation can help you make successful real estate investments. By using a Home Appreciation Calculator, you can estimate the potential future value of a property and determine whether it’s a good investment. Remember, the goal is to buy properties that will appreciate over time, increasing the return on your investment.

Understanding the Financial Aspects of Home Appreciation

In the realm of real estate and property investment, understanding the financial nuances is vital. This section delves into key concepts like cost, house valuation, and the formula for calculating home appreciation, integrating crucial NLP keywords for enhanced semantic relevance.

Home Appreciation Formula: Analyzing Your Asset

The appreciation formula helps in assessing the potential increase in a house’s value. Factors like the housing market, area-specific trends, and inflation play crucial roles. Tools like a depreciation calculator or an excel sheet for property valuation can provide detailed insights.

Appraisal and Assessment: Core to Real Estate

The process of appraisal and assessment involves professional appraisers and various tools. They analyze and assess the house to determine the appraised and assessed values. These figures are essential for calculating the loan-to-value ratio, influencing decisions like refinance and credit.

Calculating Net Profit: Beyond Home Value Appreciation

Net profit from real estate isn’t just about home value appreciation. It includes costs like fees, the impact of the area’s housing market, and the state-specific regulations. An excel calculator or a depreciation calculator can help quantify these aspects.

Refinancing and Loan Management

Refinancing can be a strategic move, influenced by the assessed value of the house, current credit situation, and prevailing interest rates. Calculators, especially those designed for specific zip areas, can help estimate the potential benefits and net profit from refinancing.

Key Financial Metrics in Real Estate

| Metric | Description | Tool/Formula Used |

|---|---|---|

| Home Value Appreciation | Increase in property value over time | Appreciation Formula |

| Appraised Value | Professional valuation of a house | Appraisal Tools |

| Assessed Value | Value for tax purposes | Assessor’s Tools |

| Loan-to-Value Ratio | Mortgage amount vs. property value | LTV Calculator |

| Net Profit | Profit from property after expenses | Calculator Excel |

| Refinance Potential | Viability of refinancing a mortgage | Refinance Calculator |

Common Myths and Misconceptions

Debunking Myths

There are several myths about home appreciation that can lead homeowners and investors astray. One common myth is that home appreciation is guaranteed. While homes generally appreciate over time, this isn’t always the case. Market conditions, location, and a host of other factors can influence appreciation.

The Truth

The truth is, home appreciation can have a significant impact on homeowners and investors. It can increase the value of your home, build equity, and contribute to financial growth. However, it’s important to have realistic expectations and understand that home appreciation is influenced by many factors.

FAQ

Can I use a Home Appreciation Calculator for any type of property?

Yes, a Home Appreciation Calculator can be used for any type of property, including single-family homes, multi-family homes, condos, and even commercial properties. However, keep in mind that the appreciation rate may vary depending on the type and location of the property.

How accurate is a Home Appreciation Calculator?

Home Appreciation Calculator provides an estimate based on the inputs you provide and the assumption that the property will appreciate at a steady rate. However, real estate markets can be unpredictable, and actual appreciation rates may vary. It’s always a good idea to consult with a real estate professional when making significant financial decisions.

Can I use a Home Appreciation Calculator to decide when to sell my home?

A Home Appreciation Calculator can help you estimate the future value of your home, which can be useful when planning to sell. However, deciding when to sell your home involves many factors, including market conditions, your personal circumstances, and your financial goals. A Home Appreciation Calculator is just one tool that can help inform your decision.

Does home appreciation always mean I’m building equity?

Home appreciation generally contributes to building equity, as it increases the value of your home. However, if you have a mortgage, other factors like the amount of your loan and the length of time you’ve been paying it off will also affect your equity.

Can negative appreciation or depreciation be calculated with a Home Appreciation Calculator?

Yes, if you enter a negative number for the annual appreciation rate, a Home Appreciation Calculator can estimate how much a property might depreciate over time. However, keep in mind that depreciation is relatively rare in real estate over the long term.

Conclusion

We’ve covered a lot of ground in this article! We’ve learned about home appreciation, how to use a Home Appreciation Calculator, and the impact of appreciation on home value, equity, and real estate investment. We’ve also debunked some common myths about home appreciation.

Now it’s your turn to put this knowledge into action. Try using our Home Appreciation Calculators to estimate the future value of your home or a potential investment property. Remember, understanding home appreciation is your key to real estate success. Happy calculating!